11 minutes

Inside Grayndler’s Rental Crisis

Sydney’s rental crisis is hitting breaking point, but for tenants in Grayndler, the Prime Minister’s own electorate, it is worse than most realise. Deceptive advertising, dangerous living conditions, and real estate industry practices that hide the truth are leaving renters vulnerable, exploited, and without recourse.

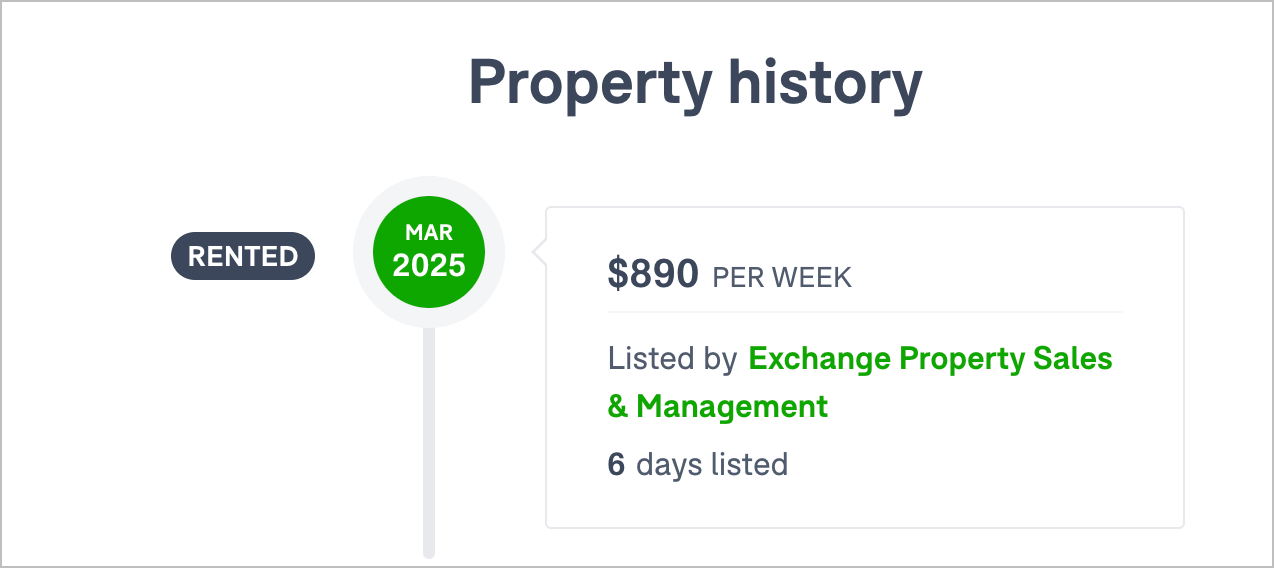

This case study reveals the hidden reality behind one $890 per week rental and why urgent reform is needed.

The Rental Crisis in Sydney’s Inner West: A Broken System

Sydney’s rental crisis has reached an unbearable point, and nowhere is it more visible than in Grayndler, the federal seat of Prime Minister Anthony Albanese.

What was once a diverse, thriving patch of the Inner West has become a pressure cooker for renters facing impossible odds; pressure that has been felt within Sydney’s inner suburbs for some time and has been bleeding throughout. Even the ‘affordable western suburbs’ are now a misnomer, pushing renters out of Sydney and into desperation – forcing those who live and work in Sydney to make compromises on the length of their commutes to work, living conditions they may never have envisioned, or both.

Every week, prospective tenants flood inspections, lining up for a chance at properties that are often barely fit to live in. They are not competing for luxury apartments, they are battling over ageing, neglected homes that command premium prices.

It’s a modern-day Stanford Prison Experiment: when landlords hold all the power and the market rewards them for it, exploitation isn’t the exception, it’s the norm.

The numbers are undeniable.

Zero properties (and virtually zero rooms in sharehouses) listed in Sydney are affordable for someone on JobSeeker or AusStudy, even with the maximum rate of Commonwealth Rent Assistance for each ($485.02 p.w. or $424.75 p.w. respectively, after taxes).

The so-called “safety net” is little more than a cruel joke for those trying to keep a roof over their head.

For young people, single parents, older Australians, and the growing number of full-time workers still struggling to pay rent, the system is overtly rigged against them.

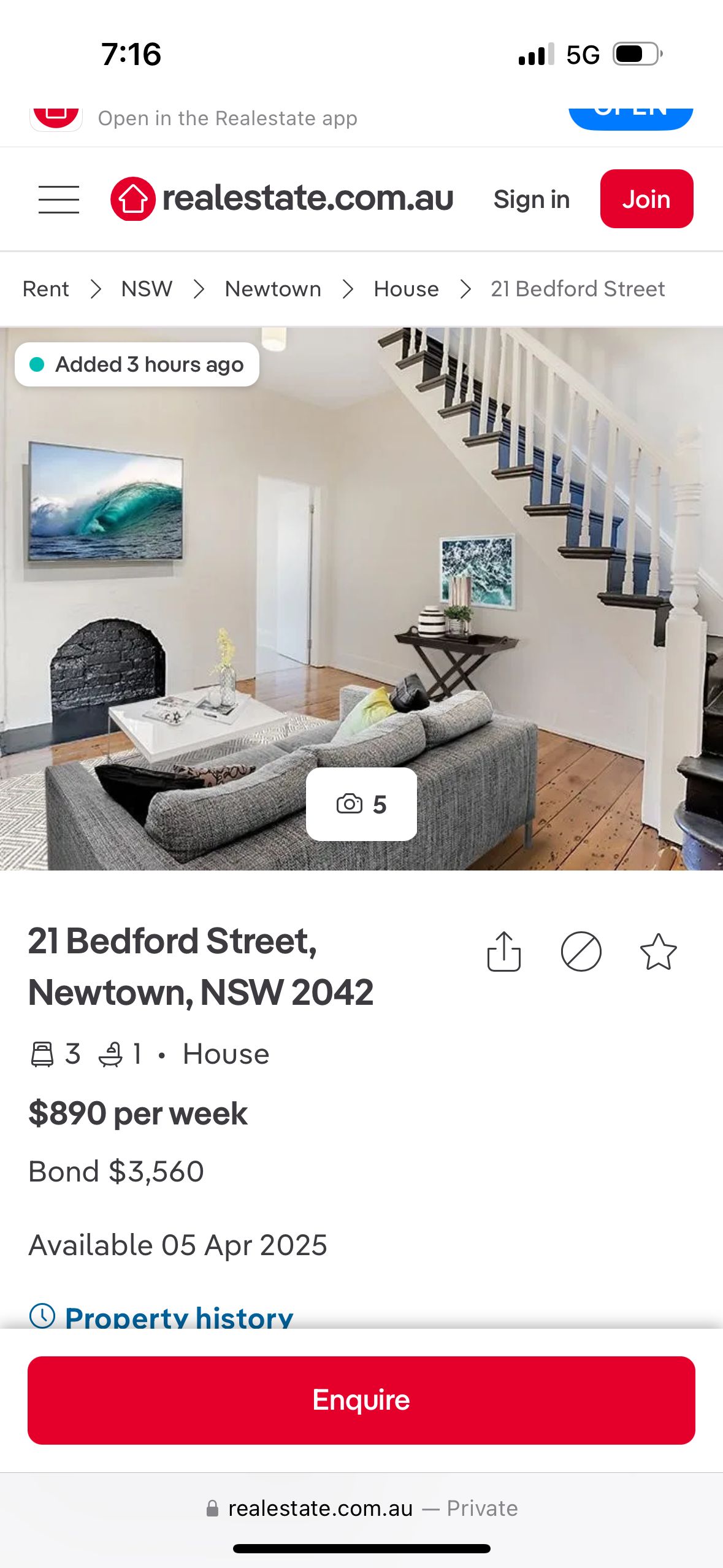

Case Study: 21 Bedford Street, Newtown

One particular rental property in Newtown I’ve attended exposes just how deep the problems run. Listed at $890 per week, it was leased within just six days of hitting the market, after being open for inspection just one time, in the middle of the week.

Reality According to Tenants

Upon inspection, and after speaking with the outgoing tenants, the true state of the property was exposed, affirming the observations I made and revealing others that one simply cannot see during a rushed 10 minute inspection:

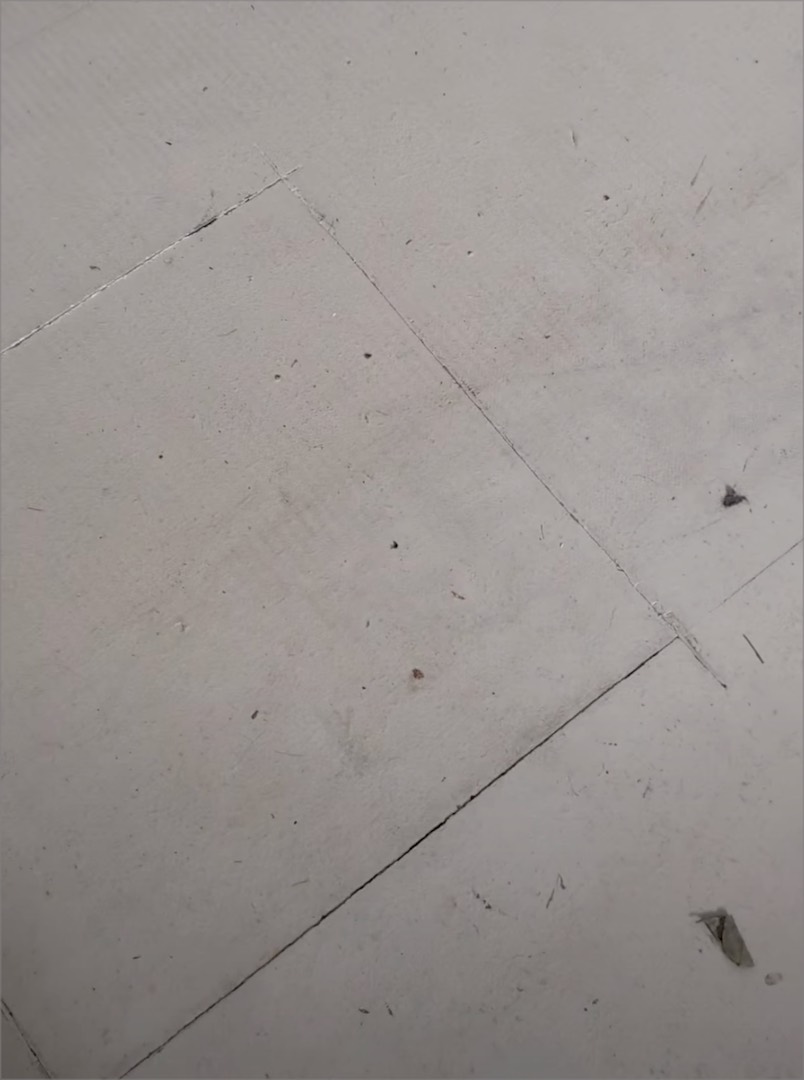

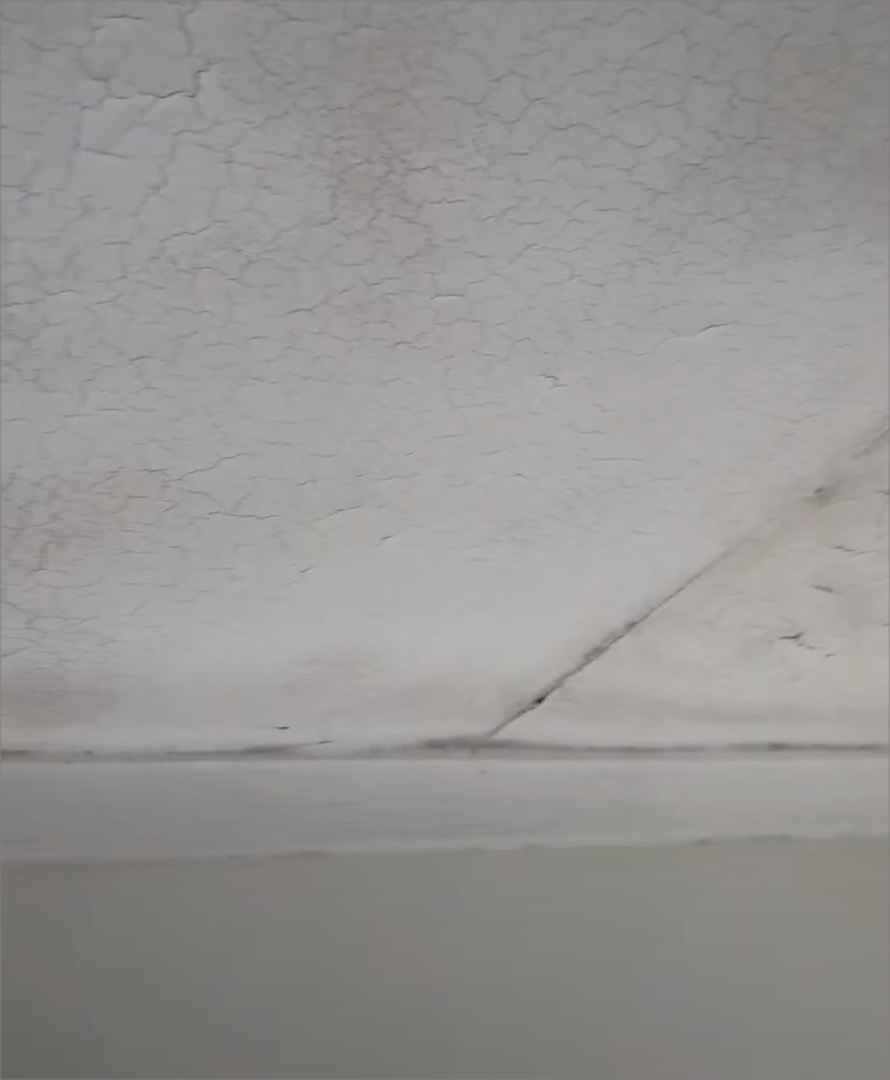

- Black mould and mildew, and extensive wood rot throughout the home.

- Large, slowly expanding holes in the flooring of the living room (which had been appropriated by the previous tenants as a bedroom), which appeared to be cheap MDF. According to the previous tenants, the actual advertised ‘third bedroom’ was too hot “almost year-round” and that irrespective of the comfort levels, it would “be a struggle to fit any more than a cot or a single bed”

- In the converted living room, now used as a third bedroom, the tenant was laying in bed when a set of blinds fell on her head. The wooden frame securing the blinds had become severely rotted due to persistent dampness.

“The front door hinge was literally held on by sticky tape.”

- A kitchen floor, covered in linoleum, that was warped, sunken, bubbled in sections, and moved when walked on; the base flooring would give, meaning one could feel the support beams beneath.

- A dishwasher with a broken handle, that often doubled as a warm roof for the roaches nesting beneath.

- The roof of an extension between the main house and bathroom, fitted together with what appeared to be hot glue - was not water-tight and often resulted in “indoor rain” during moderate storming.

- The ceiling in the so-called indoor laundry (also the only place a fridge could fit) was sagging from water damage, with mould growing inside the panels. Light pressure or an attempt to clean the mould would puncture the surface.

- Three ‘sealed’ fireplaces throughout, all of which leaked, allowing rainwater and dust to constantly enter the living area.

- Paint was peeling from most walls. The wooden stairs were uneven, worn down, and barely deep enough to walk safely. At a respectably-average 173cm tall, I had to duck under the brick headway – apparently the design did not prioritise ‘taller’ tenants.

- Applying light pressure on the shower wall was enough to shift the whole structure, with tiles lifting and threatening to fall.

- The bathroom ceiling, warped, waterlogged, brittle, and rotten throughout.

-

A roach infestation, accompanied by a rat problem. One of the rats had chewed through the laundry wall, leaving a hole where they “could see right through to the neighbours.”

-

A rear wooden gate that had completely rotted, with sections of palings missing.

The outgoing tenants confirmed that none of these significant issues were recorded or addressed by the property managers during their lease. They reported that the only maintenance completed was the cutting back of a vine on the boundary fence, and the replacement of an internal door that had swollen from water leaks to the point it could not open or close.

“How many places in the area do you know have an indoor water feature? Of course it meant your socks got wet whenever you needed to walk through to the bathroom.”

– joked one of the outgoing tenants.

This is not an isolated incident. It reflects a broader pattern across Grayndler and other areas of Sydney. Tenants who raise concerns about misleading advertising, health and safety risks, or maintenance repairs are often met with silence, indifference, or simply go unreported by tenants for fear of retaliation through eviction, rent increases, or adverse rental references should they apply to rent somewhere else.

Make it known that I am by no means a property inspector, but I wonder if the landlords would have difficulty selling this property, and if it would be deemed as fit for habitation. The system feeds itself, and is turning once sought-after suburbs in Sydney into present day slums.

Deceptive Practices in the Real Estate Industry

Worse still, real estate agents and landlords frequently engage in practices designed to obscure the true condition of properties.

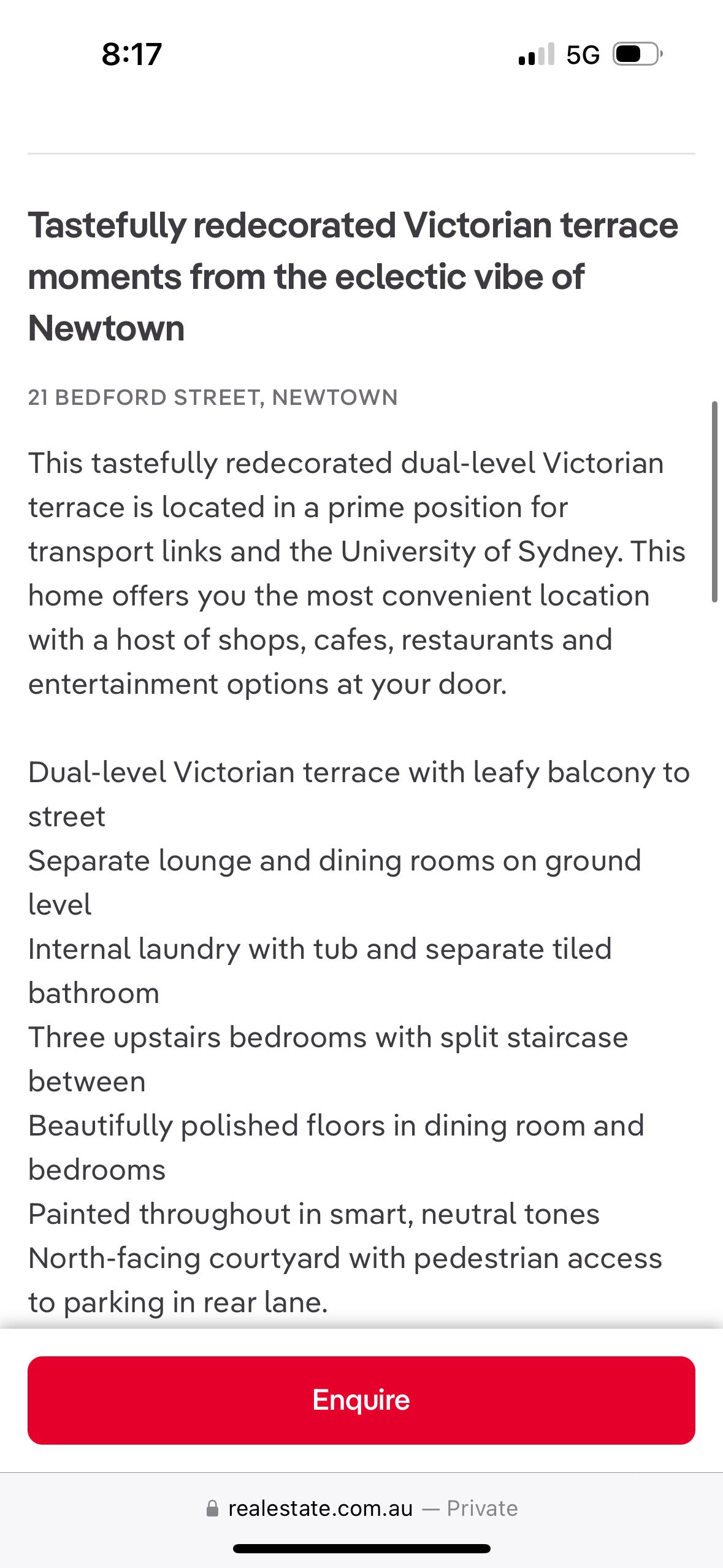

The listing photos showed a version of the property that barely matched reality. The images showed bright, freshly-painted rooms, polished floorboards, and a “tastefully redecorated” home, omitting any hint of the black mould, wood rot, water damage, or structural issues spotted during a viewing.

Listing photos – realestate.com.au – March 2025

(Uploaded: 2025-03-13)

As you can see between the photos taken by the outgoing tenants above, the photos in this ad are old or doctored (or maybe a little of both).

(Obtained: 2025-03-13)

Meanwhile, bidding wars are quietly encouraged, inflating rental prices even further. Desperation is not just expected, it is exploited.

“We’d all been looking for other places to live for months. Rental listings, Facebook share house group posts, Flatmates[.com.au], they’re all slim pickings, and all of us looking are desperate. It’s soul-crushing.”

The Broader Problem

The rental market in Sydney is broken. It is a system where landlords are rewarded for neglect, agents profit from deception, and renters are treated as disposable. It is not simply a matter of supply and demand, it is the result of deliberate choices: weak regulation, unaffordable housing, and a refusal to hold property owners and lessor’s agents accountable.

“Housing stress for renters has been at crisis levels for some years now, and sadly this year is even worse.”

– Simon Miller, CEO Anglicare Sydney

If we’re serious about protecting the future of Sydney’s communities, then we need to stop falling for the lies peddled by the major parties and their developer mates. For too long, both Labor and the Liberals have tried to boil the housing crisis down to a fake maths problem: saying it’s just a matter of supply, so they’ll throw billions of public dollars at private developers, the same private market that caused this mess in the first place.

It’s a scam.

The housing crisis isn’t some natural disaster, it’s the direct result of governments putting the profits of property investors and developers ahead of ordinary people.

If we want real change, we need urgent rental reforms: a cap on rent increases, a ban on rent bidding, minimum standards that guarantee every home is safe and liveable, and real penalties for landlords and real estate agents who lie, exploit, and neglect their tenants. Anything less is just more of the same broken system, and more communities priced out of the places they call home.

This crisis is not hidden, it is unfolding on the doorsteps of the Prime Minister’s own electorate for everyone to see.

The question is not if things will get worse, it is how much worse they will allow it to get before they stop siding with their developer donors and start fighting for renters and working people.

We cannot afford to wait for the roofs over our heads to collapse, or be priced-out of the area or our own ambitions to enter the property market. Those of my generation who manage to enter the property market, admit to getting help, getting in to the market early, getting lucky, or just ‘getting something,’ usually a compromise in size and location with a mortgage they can ‘just afford’ – just to ‘get in.’

I worry how much of Grayndler will be left by the time this seat is next contested. Communities can be hollowed out long before anyone notices – and by then, it is already too late.

Resources referenced

- Australians need six-figure income to afford average rental, report finds – ABC News (Accessed: 2025-04-27) (Archive)

- Australians ‘forever renters’: Housing crisis impacts tenants’ futures – ABC News (Accessed: 2025-04-27) (Archive)

- Solutions to rental affordability: Experts weigh in – ABC News (Accessed: 2025-04-27) (Archive)

- NSW rental laws under scrutiny – Law Society Journal (Accessed: 2025-04-27) (Archive)

- 21 Bedford Street, Newtown, NSW 2042 - House for Rent – Real Estate (Screenshots from the original rental listing (since removed with no archive available) were obtained on: 2025-03-13)

- 21 Bedford Street, Newtown | Property Value Estimate & History – Domain (Accessed: 2025-04-27)

Extra homework:

The 30/40 Rule: When Renting Becomes Financially Stressful

Renting is generally considered financially stressful when housing costs exceed 30% of a person’s post-tax income.

This threshold is often referred to as the “30/40 rule” in housing studies:

If you’re among the lowest 40% of income earners, paying more than 30% of your income on rent is considered severe rental stress.

- Below 30% of post-tax income on rent: Generally considered affordable.

- Above 30%: Likely experiencing rental stress.

- Above 50%: Often classified as extreme rental stress.

Affordable Rent Calculations (based on 30% rule)

| Income Type | Net Weekly Income | Affordable Rent (30% of Income) |

|---|---|---|

| JobSeeker + CRA | $485.02 | $145.51 per week |

| Austudy + CRA | $424.75 | $127.43 per week |

| Median Australian Employee | $1,126.15 | $337.80 per week |

Note: Commonwealth Rent Assistance (CRA) is a government subsidy designed to help eligible Australians with the cost of private rent. The figures above include the maximum CRA amounts currently available.

What This Means

- Someone receiving JobSeeker could afford a maximum rent of about $145/week before falling into rental stress.

- Someone receiving Austudy could afford around $127/week.

In reality, finding a private rental in Sydney’s Inner West (or almost anywhere in Sydney) for under $300-$500 per week, is virtually impossible. Even for a single room in a sharehouse, to avoid financial stress you would need to be on an income of $63,000 per year (excl. Superannuation).

With the median Australian employee income being just shy of $72,600/year (before tax, August 2024 [ABS]), on that income you would need to be paying less than $338/week to dodge rental stress.

This stark gap between what is affordable and what is available guarantees that many people, either gainfully employed or on income support, are experiencing severe financial stress just to maintain basic shelter.

Sources – Extra Homework section

- Housing affordability – AIHW (Accessed: 2025-04-27) (Archive)

- Housing stress facts – NSW Department of Communities and Justice (Accessed: 2025-04-27) (Archive)

- Fortnightly Tax Table – ATO (Accessed: 2025-04-29)

- Employee earnings, August 2024 | Australian Bureau of Statistics (Accessed: 2025-04-29) (Archive)

About the Author

Rob Di Toro moved to the edge of Sydney’s Inner West, settling in Ashfield in 2023 after spending 21 years in Canberra.

He did not expect that, in his mid-thirties and earning a six-figure salary, he would still need to share a house with two others just to afford living in Sydney.

At first, he was thrilled looking at the electorate map to discover that his new sharehouse fell within Anthony Albanese’s electorate. Today, he is a disillusioned former Labor voter who believes both the ALP and L/NP are responsible for taking the Australian dream away from younger generations.

2298 Words

2025-04-29 13:58 (Last updated: 2025-04-29 23:25)